Upgraded Points recently surveyed more than 2,300 U.S. travelers about how often they purchase travel insurance, what they spend, and which vacation expenses they are most eager to protect. The comprehensive results reveal regional trends, demographic differences, and the lingering impact of past travel hassles on today's insurance decisions.

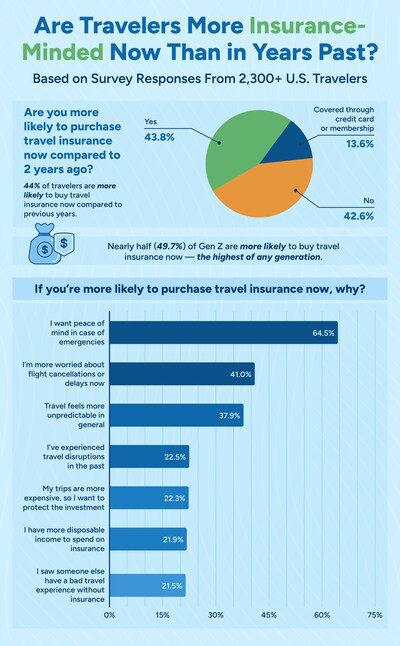

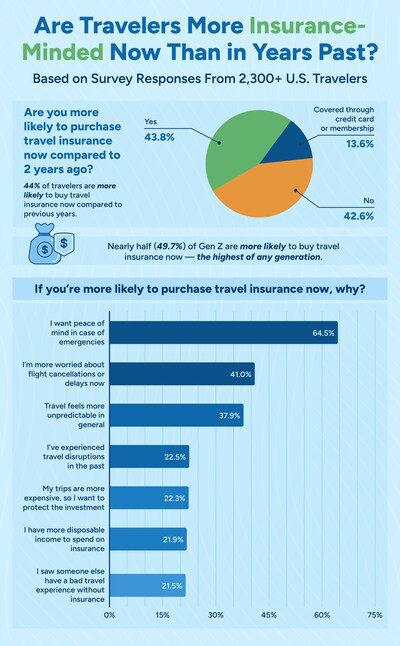

Are Travelers More Insurance-Minded Now?

Are Travelers More Insurance-Minded Now?

"With flight cancellations, hotel surprises, and economic unpredictability on the rise, travel insurance has never been more relevant, yet many Americans still skip it," said Keri Stooksbury, editor-in-chief at Upgraded Points. "Despite the dangers, our survey shows that many travelers are willing to gamble with travel security, and that's often based on where they live and how they travel."

Study Methodology

2,359 U.S. travelers from 45 states were surveyed about their 2025 travel insurance habits, spending, perceived risks, and past trip disruptions; the responses represent a varied mix of ages, incomes, and travel frequencies. Due to low response rates, Alaska, Montana, North Dakota, Vermont, and Wyoming were excluded from state-level comparisons.

Major Overviews and Trends

- Lifetime insurance uptake: 58.6% of U.S. travelers have purchased travel insurance at least once. 41.5% have never done so.

- 2025 coverage gap: For trips this year, 63% of Americans have skipped travel insurance altogether.

- What gets insured: Flights top the list (54.8%), followed by car rentals (44.8%) and hotel bookings (34.5%).

- State leaders: Maryland leads with 49% of travelers insuring their 2025 trips, just ahead of California (48.2%), Louisiana (48.1%), and Texas (46.6%).

- Budgeting for protection: 59% of Americans spend less than 5% of their total trip budget on insurance.

- Perceived risk: 43.2% view travelling uninsured as only "slightly risky."

- Actual losses: While 17.3% report losing money by skipping coverage, a full 82.7% say they have not suffered any financial setbacks.

- Virginia's warning: In Virginia, 28% of travelers have lost money by going without insurance – the highest rate of any state.

Who's Buying Travel Insurance?

Not all travelers are the same: Millennials lead the pack in skipping coverage, with 65% going uninsured in 2025. While frequent flyers are far more cautious, those who fly 3 to 5 times a year insure their trips at a rate of 38.4%. Flyers that travel 6 to 10 times per year insure at a rate of 43%, versus just 19% for occasional travelers (averaging 1 to 2 trips).

These states lead the nation in protecting their vacations with travel insurance:

- Maryland (49.0%) residents insure nearly half of all 2025 trips, more than any other state.

- California (48.2%) follows closely, reflecting strong awareness of travel risks among West Coast travelers.

- Louisiana (48.1%) ranks third, with nearly half of its residents opting for trip protection.

Who Skipped the Insurance?

Midwestern and Western landlocked states tend to leave their trips unprotected:

- Colorado: 22.6% insured their 2025 trips

- Montana: 23.3%

- Iowa: 23.4%

- Idaho: 25.0%

- Michigan: 25.5%

Travel insurance habits can vary widely: 19.3% of travelers always or usually buy coverage, 37% never do, and 32.2% purchase it only occasionally or about half the time. The rest depend on credit card perks or membership-based plans for trip protection.

Copyright 2025 PhoCusWright. All rights reserved. From https://www.phocuswright.com.